Ready to Sell Your House? Call (323) 973-2250

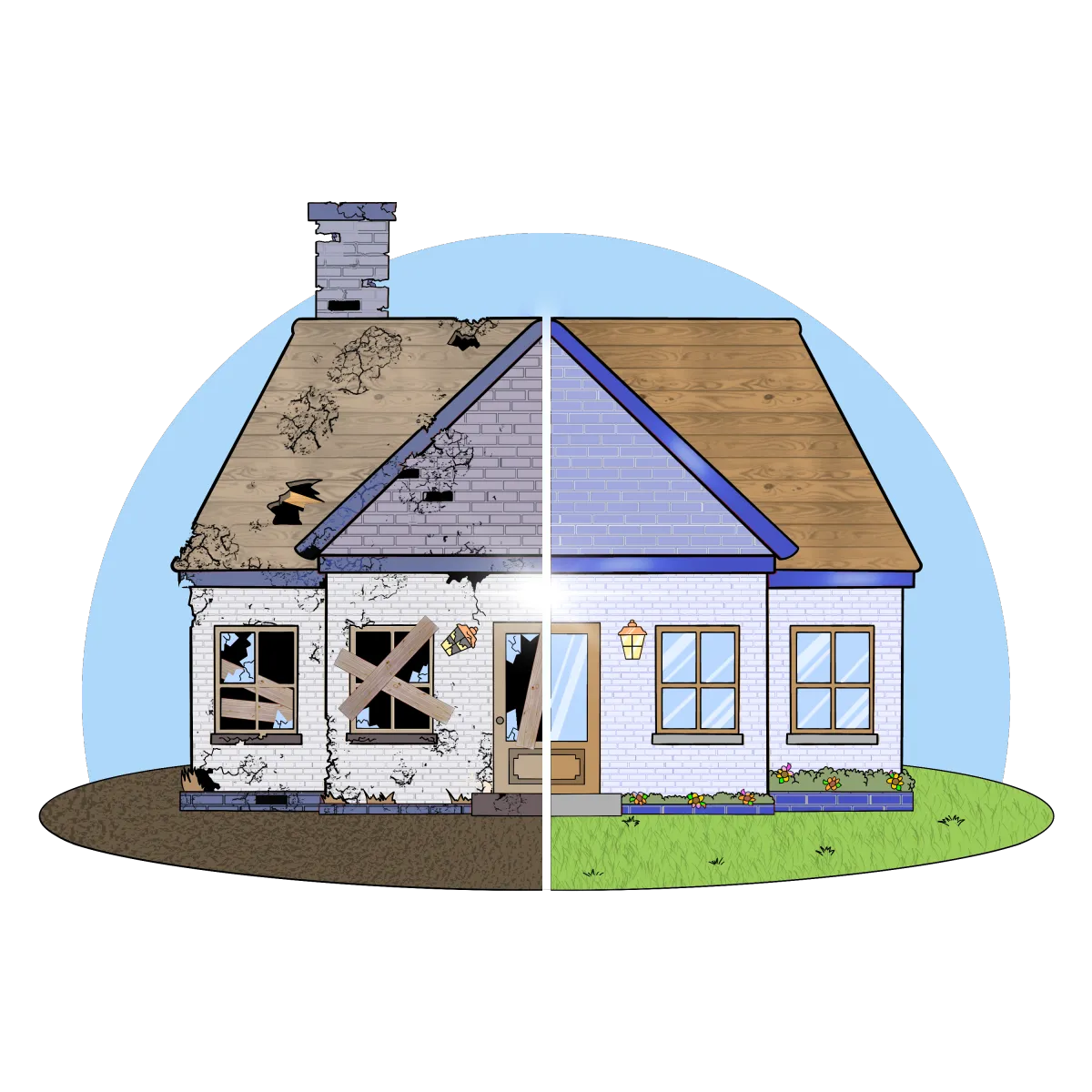

Save Your Home Before It’s Too Late: Sell Your Property to Avoid Foreclosure

Facing Foreclosure? Take Control of Your Future and Avoid Auction—We Can Help You Sell Your Home Quickly and Secure Financial Stability.

Section 1: What is Foreclosure?

Foreclosure is the legal process that happens when a homeowner defaults on their mortgage payments, and the lender seeks to recover the outstanding loan balance by selling the property. In California, once a homeowner has missed a few payments, the lender issues a Notice of Default (NOD). This starts the foreclosure timeline, and the homeowner risks losing their home.

Key Points:

Default

: Missing mortgage payments leads to default.

Notice of Default

: The lender files this with the court to officially start the foreclosure process.

Risk of Auction

: If the default isn’t resolved, the home will eventually be auctioned.

Foreclosure can severely impact your financial future, but there are ways to avoid it, including selling your home before the auction date.

If you’re facing foreclosure, it’s critical to act fast. Selling your home before the foreclosure auction can help you save your credit and avoid losing everything.

Section 2: Understanding the Foreclosure Process in California

The foreclosure process in California is fast-moving, with specific legal steps that homeowners need to be aware of:

Notice of Default (NOD)

: After missed payments, the lender files the NOD, which starts a 90-day period for homeowners to cure the default.

Notice of Trustee Sale (NTS)

: If the default isn’t resolved within 90 days, the lender files the NTS, scheduling the property for auction after a 21-day waiting period.

Auction

: The property is auctioned to the highest bidder, often resulting in the homeowner losing the home.

Each stage in the foreclosure process provides a window of opportunity to sell your home before the auction. Don’t wait until the final stage—reach out to us for help navigating your options.

Section 3: How Long Does the Foreclosure Process Take?

The foreclosure timeline in California usually takes 4-6 months from the initial Notice of Default to the auction date, but it can move faster in some cases. The process can be stressful, but knowing the timeline can help you act in time.

Factors Affecting Foreclosure Duration:

Response Time

: Homeowners who take immediate action, such as negotiating with the lender or selling the property, can extend the process.

Loan Modifications

: If a lender agrees to modify the loan terms, this can temporarily halt the foreclosure process.

Market Conditions

: The time it takes to sell a home can also impact how quickly foreclosure proceeds

Although the foreclosure process can seem overwhelming, we can help you navigate it. Selling your home before the auction can save your credit and allow you to move forward without financial strain.

Section 4: What Happens at a Foreclosure Auction?

A foreclosure auction is the final step in the foreclosure process. Once the lender files a Notice of Trustee Sale, the property is scheduled for auction. This is typically a public event where the home is sold to the highest bidder. The homeowner loses the property, and any equity they may have built up is forfeited.

Key Points About Foreclosure Auctions:

Auctions are public, and anyone can bid on the property.

The homeowner loses ownership of the home once the auction is completed.

In some cases, if the property sells for less than the mortgage balance, the homeowner could still be liable for the remaining debt (depending on the loan type).

Avoid the uncertainty of an auction by selling your home before it reaches this stage. Our team can provide a fast cash offer, helping you settle your debts and move on with peace of mind.

Section 5: How We Help Homeowners Avoid Foreclosure

Selling your home before the foreclosure auction is the best way to avoid losing your property and protect your credit. We specialize in buying homes quickly, helping homeowners like you get out of foreclosure without the stress of waiting for an auction.

Benefits of Selling Before Foreclosure:

Save Your Credit

: Avoid the long-term damage that foreclosure can cause to your credit report.

Quick Sale

: We can close in as little as 7-14 days, giving you the funds you need to pay off your debts.

No Fees

: We cover closing costs, and there are no real estate commissions to pay.

We make the process of selling your home fast and stress-free, helping you avoid the worst consequences of foreclosure. Contact us today to learn more about how we can help.

Section 6: Selling to Us vs. Waiting for the Auction

Selling your home before foreclosure offers more control, financial stability, and a faster resolution than waiting for the auction. When you sell to us, you get a cash offer and a quick close, helping you avoid the uncertainty of the auction process.

Comparison

Selling to Us:

Quick sale in 7-14 days.

You receive a cash offer.

No fees or commissions.

Waiting for Auction:

Potential loss of equity.

Uncertainty about the final sale price.

Long-term damage to credit.

Selling your home before foreclosure is the smarter choice. We can help you sell quickly and avoid the financial and emotional stress that comes with an auction.

Section 7: Client Testimonials

Our clients’ success stories speak volumes about the benefits of selling before foreclosure. Here's what they have to say:

"Selling our home before the auction was a huge relief. They made the process easy and saved us from losing everything."

— Sarah & John, Riverside, CA

"We were able to sell fast and get out from under our mortgage without damaging our credit. We’re so grateful!"

— David, Palmdale, CA

Section 8: Frequently Asked Questions (FAQ)

Q: How long does it take to sell my home before foreclosure?

A: We can close the sale in as little as 7-14 days, giving you time to settle your debts and move on.

Q: What are the costs involved in selling my home to you?

A: We cover all closing costs, and there are no real estate commissions when you sell directly to us.

Q: How does selling before foreclosure affect my credit?

A: Selling your home before foreclosure can help protect your credit from the long-term damage that foreclosure would cause.

If you’re facing foreclosure, don’t wait. Reach out to us today for a free consultation and learn how we can help you protect your future.

Fill Out Our Quick Form To Get Your Quick Cash Offer

By clicking "I Want To See My Options ” I agree to receive text message and phone calls from "buyorsellmyhousequick.com" to the provided mobile number and also agree to the "buyorsellmyhousequick.com" terms and privacy policy found on www.buyorsellmyhousequick.com